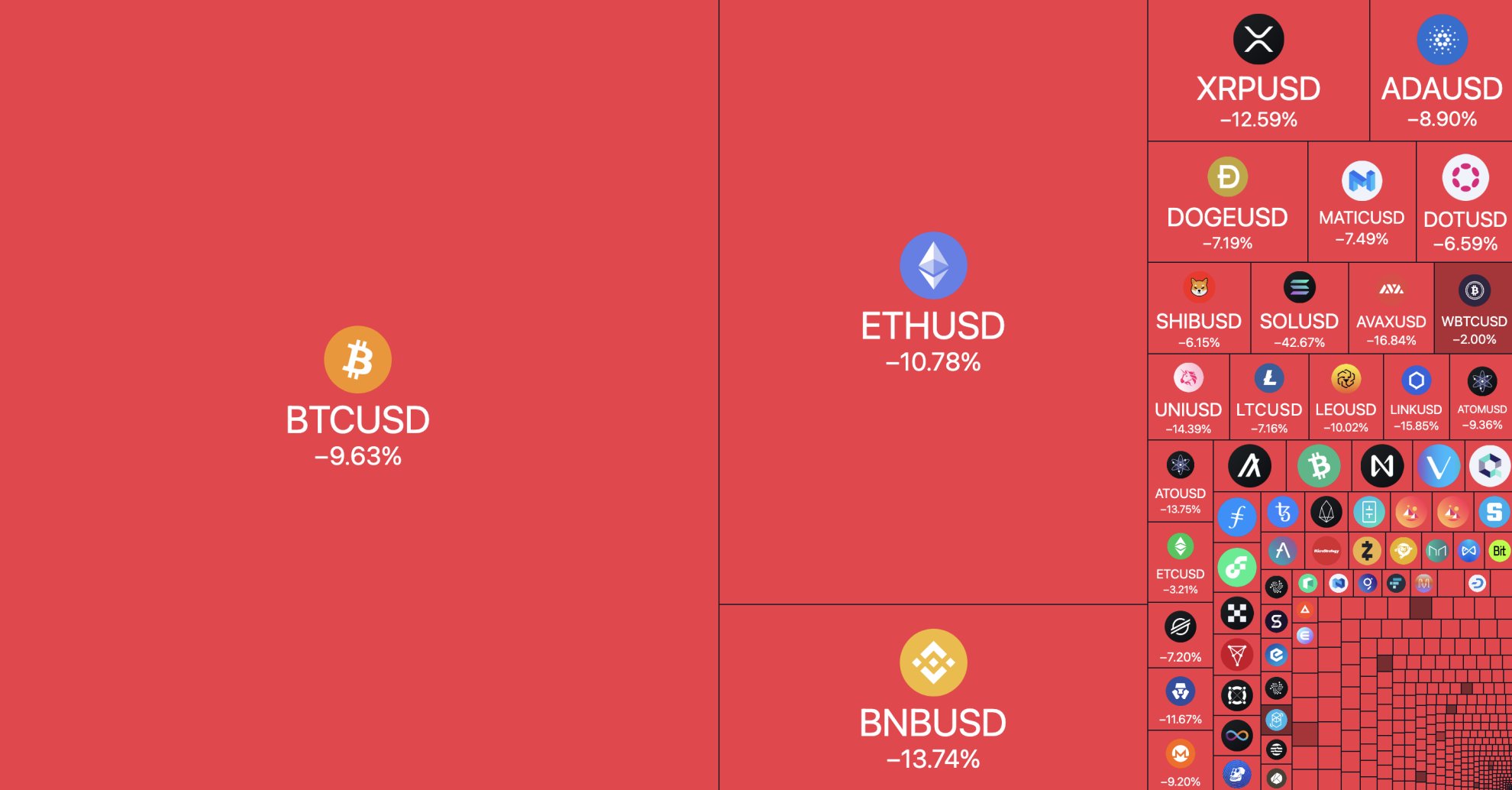

Marijuana stock investors have had to adapt to the way of the sector. Even with more to be seen in the cannabis industry marijuana stocks continue to show a lack of upward momentum. Even when the sector begins to see some type of recovery it does not last very long. This has been tough for some and others have made the adjustment. Unfortunately, the cannabis sector is one with a large amount of volatility and patterns can change without warning.

Yet at one point in time when marijuana stocks would see a decline, they could recover to higher highs and display consistency in momentum. However, currently, that is not the case but even with the sector in its current state investors continue to trade marijuana stocks. The cannabis industry is growing and evolving and with a new year about to begin comes new opportunities. Specifically dealing with the passing of federal reform.

Hopefully, 2023 is the time in which some type of federal reform is passed. Right now congress and advocates are working to make it happen. Particularly with cannabis banking being what they feel is the shorter road to Rome. Meaning that if we can pass the SAFE act it will be a better path to see the end of cannabis prohibtion which as many feels will have a positive impact on marijuana stocks. So if you are looking for cannabis stocks to watch the companies below could be for you.

Marijuana Stocks To Watch In The Stocks Market

Aurora Cannabis Inc.

OrganiGram Holdings Inc.

HEXO Corp

Medical cannabis net revenue1 was $31.6 million, a 14% decrease from the prior quarter and a 23% decrease from the prior year period, delivering 64% of Aurora’s Q1 2023 consolidated net revenue1 and 86% of Adjusted gross profit before fair value (FV) adjustments1.

The decrease in net revenue1 from Q4 was primarily attributable to timing of… See More shipments into certain international markets during the prior quarter, with sales expected to normalize in Q2 2023. The decrease from the prior year quarter was driven by $7.9 million of sales to Israel and a strategic choice to shift our Canadian medical business towards the higher margin insured patient base. Adjusted gross margin before FV adjustments on medical cannabis net revenue1 was 67% compared to 62% sequentially and 64% in the prior year period. The continued strength of the Company’s medical adjusted gross margins1 reflects the direct-to-patient model in Canada and sustained presence in the high-margin international medical business.

Comments (0)